Strauss Group (TASE: STRS) announced its financial results for the full year 2022 with revenue growth countered by profit and margin erosion. The company’s results demonstrate growth in most categories, including the coffee business in Brazil and Eastern Europe, the water business in Israel and China, and most of Strauss’s business categories in Israel.

Revenues were impacted by the recall in the confectionery division and the partial suspension of production in Sabra for several months in 2022. Sabra’s dips and spreads manufacturing site in Virginia and the confectionery plant in Nof Hagalil resumed production during 2022 and have regained market share since. In March 2023, the confectionery division’s market share reached an average of 24%2, which is close to market share prior to the recall, while Sabra’s share of US hummus market was 31.2% at the end of 2022 and was up to 37.6% in recent weeks, compared to 61.6% before the shutdown3.

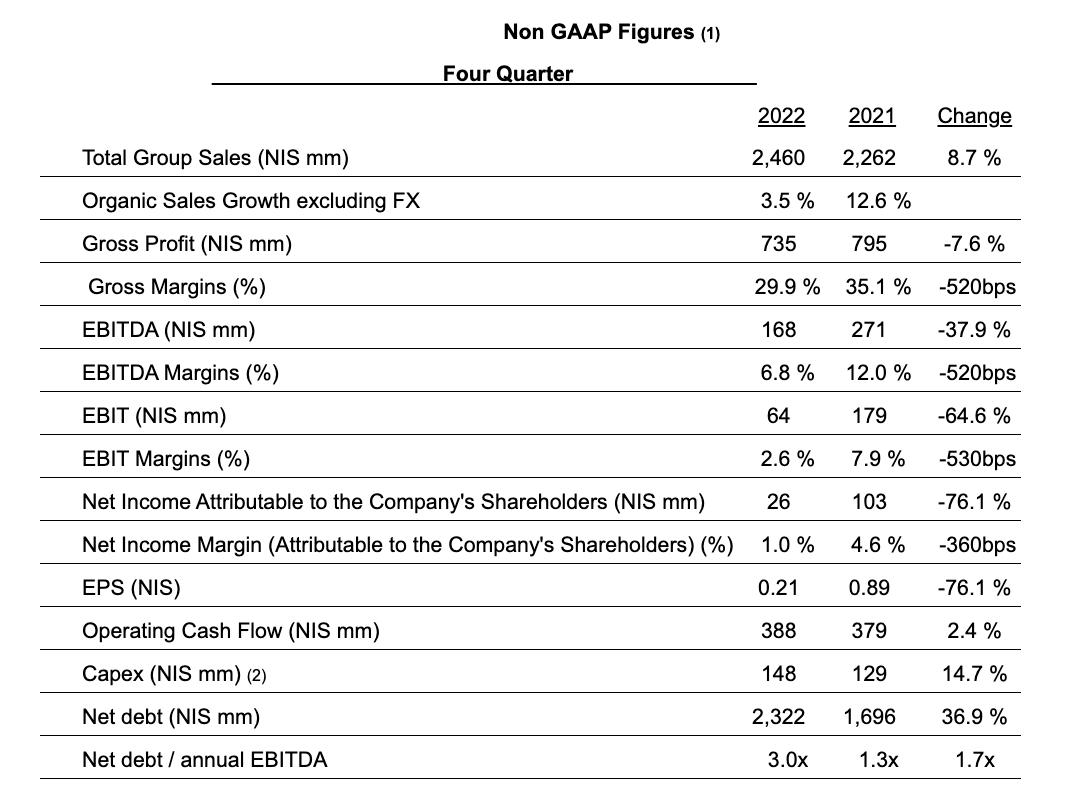

The Group’s revenue in 2022 grew 6.5% to NIS 9.5 billion (organic, excluding foreign currency effects). Gross profit was down 12.3% and amounted to NIS 2.8 billion, with the gross margin falling to 29.8% compared to 36.9% in 2021. Gross profit and margin erosion was largely due to the recall in the confectionery division, the adjustment plan in the Sabra plant and the rising prices of green coffee, raw milk, packaging materials and energy. This led to erosion of the Company’s operating profit, which dropped 61.4% compared to 2021 to NIS 379 million, and to a decline of 72.9% in net profit, which dropped to NIS 174 million.

Ofra Strauss, Chairperson of Strauss Group: “2022 was a year in which we dealt with internal and external challenges, whilst investing in the group’s infrastructure as a foundation for our future resilience. During the past year, our commitment and values were a compass that guided our path. It was crystal clear to us that we are a company that places the health and safety of our consumers and people above anything else.

“A company that handles the challenges of the present and builds the future with a long-term vision. The strategy that we launched at the beginning of 2022 included adjustments that the company is required to make and capabilities that it is required to build over the next ten years. This includes investing in production sites infrastructures and in new technologies, nurturing the skills of the company’s employees and making organizational changes as per our strategy.

“This is an opportunity to thank Giora Bardea who recently retired from the role of CEO of the group after 5 years, for his leadership, the ongoing management and for preparing the group for the future; and I would like to wish Shai all the best in these future endeavors.

“In the past few months, we made changes in the Group’s management. We are investing in innovation, upgrading our production sites and continuously adapting ourselves to fulfill emerging expectations, while maintaining our commitment to improve our positive impact on people and on the environment.”

Shai Babad, Strauss Group CEO: “Strauss delivered growth that is the result of the strong performance by the international coffee business, Strauss Water, the food division, the dairies and salty snacks in Israel. Sabra in the US and the confectionery division in Israel have resumed production and are consistently growing their market shares.

“In Q4 2022, and even more so as we entered 2023, the Group continued to implement its strategy, with three managerial focus areas: Recover, Transform, Perform.

“In November 2022, we signed an update to the partnership agreement in Brazil and its extension for another 20 years. In December 2022, we approved an investment for the construction of another plant for the production of water bars in China. In January 2023, we announced the expansion of the water business in the UK through a partnership with the global water treatment company, Culligan International, and in February, 2023 , we terminated Obela’s business in Europe.”

“At the end of 2022, Strauss Group parted ways with Giora Bardea, who stepped down from his post after five years as CEO and almost 30 years at Strauss Group. This is an opportunity for me to thank him personally for the way he introduced me to the position, and for his personal and professional support during my first months as CEO.”

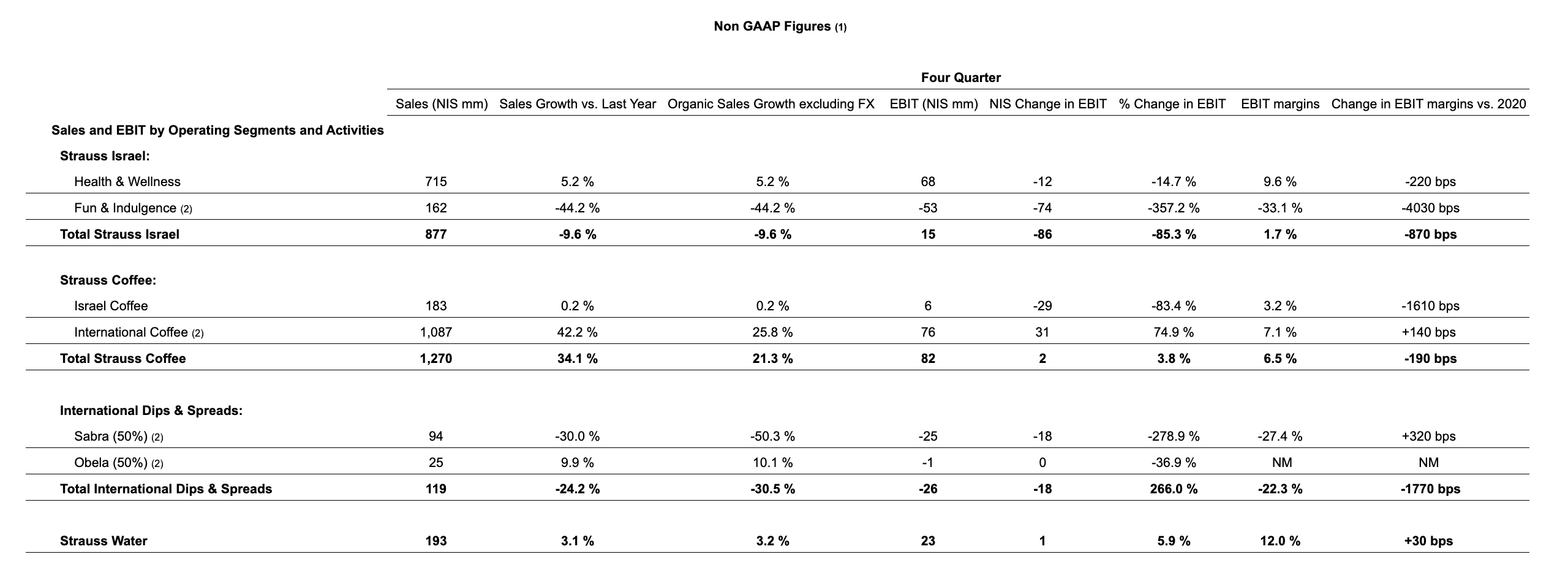

Strauss Israel ended 2022 with NIS 3.5 billion in sales, down 8.9%. The Company delivered sales growth in all divisions, especially in dairies, food, and salty snacks, which offset the drop in sales by the confectionery division.

In 2022, Strauss Israel continued to launch new products to a variety of communities, including new Danone Pro products, Pro beverages, expansion of the Alpro offering of drinks in the plant-based world, Danone Multi for the Third Age, and other product variation launches throughout the year in the various divisions.

Strauss Coffee’s business in Israel grew 6.9% in 2022 to NIS 778 million, thanks to increased sales to the retail market and AFH channel. However, operating profit and the operating margin eroded, mainly due to the increase in green coffee prices as well as higher energy and packaging material costs.

Sales by the coffee company in Brazil grew in 2022 to NIS 2.66 billion (50% ownership), an increase of 43.7% in local currency, largely the result of higher sales prices as well as the weakening of the shekel against the Brazilian real. The coffee business in Eastern Europe also delivered double-digit growth in local currency in all countries where the company is active: Russia-Ukraine, Poland

Sabra concluded 2022 with sales of NIS 328 million (50% ownership), a decline of 46.9% in local currency due to the shutdown of the plant in Virginia from April until resuming production in August. Obela ended the year with NIS 87 million in revenue (50% ownership), up 7.3% in local currency.

Strauss Water delivered another strong year with 6.7% organic sales growth, with sales rising to NIS 785 million thanks to growth in the customer base and in sales of new appliances. In 2022, sales in China[4] rose 7.8%, mainly due to growth in the number of points of sale, despite lockdowns during part of the year due to renewed COVID-19 outbreaks. In December, HSW’s board of directors decided to build a second manufacturing site in China.

(1) The data in this document are based on the company’s non-GAAP figures, which include the proportionate consolidation of jointly controlled businesses and do not include share-based payment, mark-to-market at end-of-period of open positions in the Group in respect of financial derivatives used to hedge commodity prices and all adjustments necessary to delay recognition of gains and losses arising from commodity derivatives until the date when the inventory is sold to outside parties, other income and expenses, net, and the tax effect of excluding those items, unless stated otherwise.

(2) Investments include the acquisition of fixed assets, investment in intangible assets and proceeds from the sale of fixed assets.

Note: Financial data were rounded to NIS millions. Percentages changes were calculated on the basis of the exact figures in NIS thousands.