Jamieson Wellness Inc. reported financial results for its fourth quarter and the year ending December 31, 2022. All amounts are expressed in Canadian dollars. Certain metrics, including those expressed on an adjusted basis, are non-IFRS and other financial measures.

Highlights of Fourth Quarter 2022 Results versus Fourth Quarter 2021 Results

- Revenue increased by 48.5% to $192.8 million;

- Jamieson Brands’ revenue increased by 56.3%, with organic growth of 5.6%;

- Adjusted EBITDA(1) increased by 44.7% to $48.9 million;

- Net earnings were $22.1 million and Adjusted net earnings(1) increased 30.6% to $26.8 million; and

- Diluted earnings per share were $0.52, and Adjusted diluted earnings per share(2) increased 26.5% to $0.62

Highlights of Full Year 2022 Results versus Full Year 2021 Results

- Revenue increased by 21.4% to $547.4 million;

- Jamieson Brands revenue increased by 27.9%, with organic growth of 8.1%;

- Adjusted EBITDA(1) increased by 23.6% to $123.8 million;

- Net earnings were $52.8 million and Adjusted net earnings(1) increased 18.0% to $65.1 million; and

- Diluted earnings per share were $1.25, and Adjusted diluted earnings per share(2) increased 17.4% to $1.55

“2022 was a transformative year for Jamieson Wellness,” said Mike Pilato, President and CEO of Jamieson Wellness. “In addition to celebrating our 100th year of improving the world’s health and wellness with our Jamieson brand, we made significant advancements in our primary growth pillars as we continue to expand our category leadership globally beyond this milestone year.

“Throughout 2022, we saw consistent growth in our brands in Canada, as Canadian consumers continued to trust Jamieson for their health and wellness needs. In July, we closed on our acquisition of the youtheory brand, providing us with a strong platform and premium brand offering in the United States. In just a few short months we have identified and begun to execute multiple opportunities to leverage our combined strengths across channels, product innovation and capabilities to drive revenues and profitability in 2023 and beyond. In November, we announced the pending acquisition of our Chinese distributor’s assets. This is a natural evolution of our strategy and supports significant brand expansion as we transition to full control of the value chain, enabling us to capitalize on our strong momentum in the world’s second largest VMS market.

“These major strategic actions defined our centennial year and have placed us in a strong position for growth as we enter our next century of helping consumers around the world optimize their health and wellness. We delivered solid performance across our business in 2022 with total revenues up 21%, while profitability was similarly strong with adjusted EBITDA increasing 24%. We are extremely proud of our team for our achievements in 2022, and equally excited for the future. In 2023, we will continue to invest in our long-term opportunities, with a focus on our four primary growth pillars of Canada, U.S., China and International. We will continue to build our world-class brands by leveraging our best-in-class marketing, innovation and omni channel distribution capabilities to drive significant global expansion of our high-quality products and enhance value for all stakeholders.”

Fourth Quarter 2022 versus Fourth Quarter 2021 Results

Revenue increased 48.5% to $192.8 million in the fourth quarter of 2022 driven by 56.3% growth in the Jamieson Brands segment and 22.4% growth in the Strategic Partners segment.

- Jamieson Brands segment revenue increased by $56.2 million or 56.3% driven by the following:

- Jamieson Canada revenue growth of 6.3%, reflecting continued consumer demand, higher average retailer inventories in conjunction with a severe cold & flu season, and in-year pricing;

- Jamieson China revenue growth of 41.5%, reflecting strong consumer demand as COVID-19 related lockdowns were eliminated in the quarter;

- Jamieson International revenue decline of 21.0%, largely resulting from geopolitical and economic pressures in eastern Europe and delayed entry into certain markets due to regulatory changes;

- Newly acquired youtheory business in 2022 contributed revenue of $50.6 million driven by seasonally higher promotions ahead of new year offset by lower customer inventory levels as specific partners reduced stocks on-hand in support of 2023 innovation plans.

- Strategic Partners segment revenue increased by $6.7 million or 22.4%, to $36.8 million reflecting pricing to maintain existing margin structure and volume changes of customer products.

Gross profit increased 44.1% to $71.2 million in the fourth quarter of 2022. Gross profit margin(3) decreased by 120 basis points to 36.9% in the fourth quarter of 2022, driven by 80 basis points from youtheory gross profit margins which are inherently lower than the base business and 40 basis points due to a higher proportion of Strategic Partner sales.

Selling, general and administrative (“SG&A”) expenses increased by $13.2 million to $32.8 million in the fourth quarter of 2022. Normalized SG&A(1) increased by $8.8 million driven by the inclusion of the youtheory acquisition of $7.0 million while expanding its resources and marketing activity plus $1.8 million in the base business.

Earnings from operations increased 28.5% to $37.1 million in the fourth quarter of 2022 and operating margin(3) decreased by 300 basis points to 19.2% due to factors affecting gross profit margin and higher SG&A investments discussed above. Normalized earnings from operations(1) increased by $13.4 million or 46.2% in the fourth quarter of 2022 and normalized operating margin(2) was 22.0% compared with 22.4% in the fourth quarter of 2021.

Adjusted EBITDA increased by 44.7% to $48.9 million in the fourth quarter of 2022 and Adjusted EBITDA margin(2) was 25.4% compared with 26.0% in the fourth quarter of 2021 as youtheory Adjusted EBITDA margins are inherently lower than the base business.

Interest expense and other financing costs increased by $4.4 million to $5.8 million due to higher average borrowing rates and higher borrowings to support the youtheory acquisition.

Net earnings for the fourth quarter of 2022 were $22.1 million compared with $20.2 million in the fourth quarter of 2021. Adjusted net earnings increased by $6.3 million, or 30.6%, to $26.8 million in the fourth quarter of 2022.

Adjusted net earnings in the quarter exclude costs associated with foreign exchange gain/loss, acquisition related costs, IT system improvements, and other non-operating earnings or expenses net of related tax effects. A quantitative reconciliation of reported net earnings to EBITDA, Adjusted EBITDA, and non-IFRS normalized gross profit, normalized SG&A, normalized earnings from operations and Adjusted net earnings are included in the table accompanying this release under the heading “Non-IFRS and Other Financial Measures”.

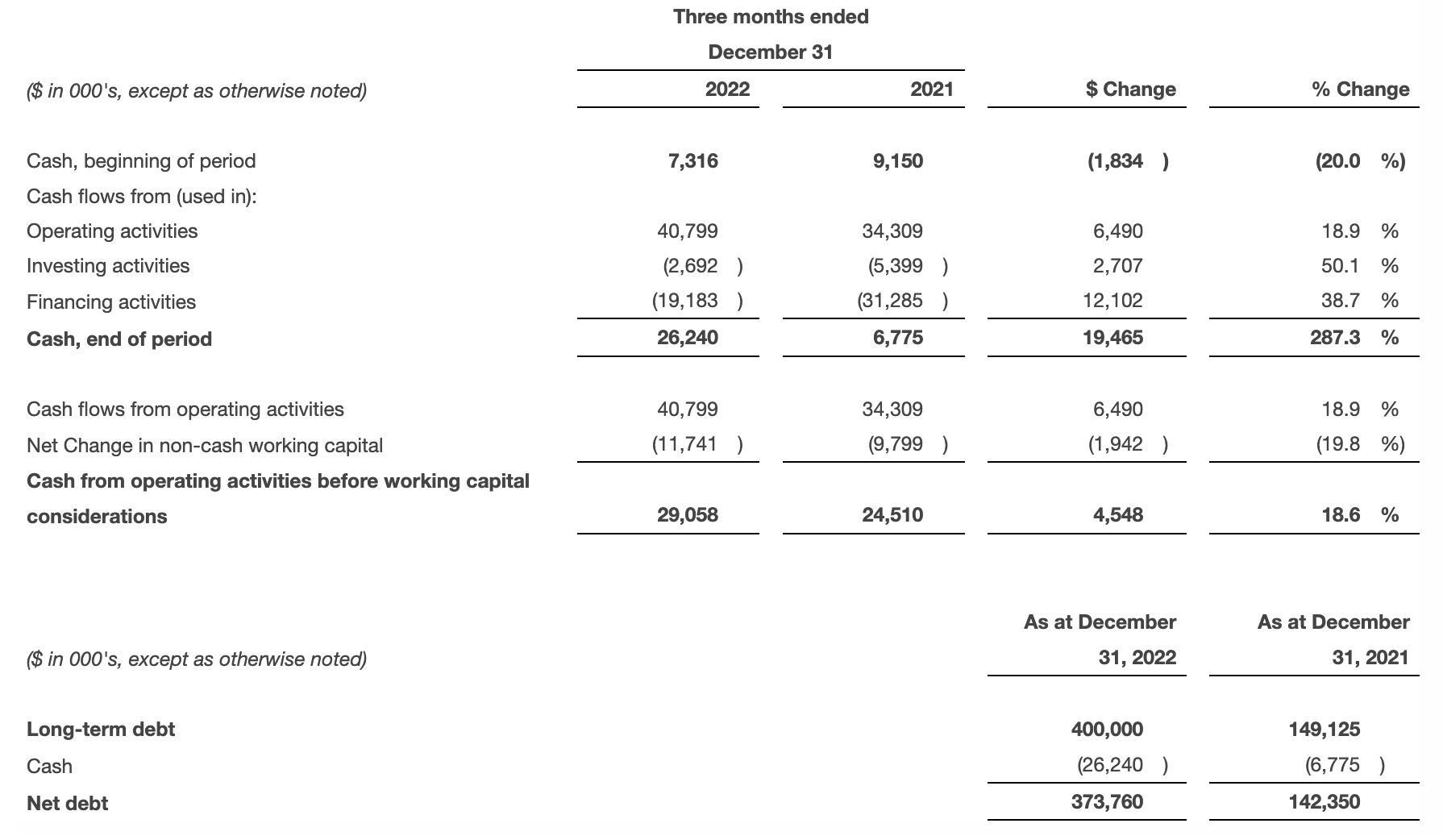

Balance Sheet & Cash Flow

The Company generated $40.8 million in cash from operations during the fourth quarter of 2022 compared with $34.3 million generated in the fourth quarter of 2021. Cash from operating activities before working capital considerations(1) of $29.1 million was $4.5 million higher due to increased earnings in the current quarter. Cash generated from working capital increased by $1.9 million mainly driven by favourable timing of payables and accelerated inventory purchases realized earlier in 2022. The Company’s cash as at December 31, 2022 was $26.2 million compared with $6.8 million on December 31, 2021 due to foreign currencies (U.S. dollars) held for short-term obligations in Canada as well as the impact of its expanded global operations. The Company ended the year with approximately $126.2 million in cash and available operating lines and net debt(1) of $373.8 million.

Fiscal 2023 Outlook

The Company is introducing its outlook for fiscal 2023 and anticipates revenue in a range of $670.0 to $700.0 million, which represents annual growth of 22.0% to 28.0%. The Company estimates Adjusted EBITDA in a range of $140.0 to $146.0 million representing approximately 13.0% to 18.0% growth and Adjusted diluted earnings per share in a range of $1.62 to $1.72.

This outlook for revenue growth reflects the following assumptions:

- Jamieson Brands segment revenue growth of 24.0% to 30.0%, driven by the following:

- Jamieson Canada revenue growth of 3.0% to 6.0%, reflecting continued consumer demand, marketing plans, innovation, and the impact of prior year pricing;

- Youtheory revenue of between $145.0 and $155.0 million (approximately 11.5% to 19.0% on a pro-forma basis) driven by product innovation, expanded e-commerce initiatives and distribution gains;

- Jamieson China revenue to increase by 65.0% to 75.0%, reflecting a transition to an owned distribution model and the related step-up in distributor level pricing realized on revenues beginning the second quarter of 2023 along with continued consumer demand in e-commerce and distribution gains in the domestic retail channels (approximately 25.0% to 30.0% growth on a pro-forma basis);

- Jamieson International revenue growth of 5.0% to 20.0% driven by marketing, innovation, and distribution into new markets as well as expansion across key regions.

- Strategic Partners segment revenue growth of 15.0% to 20.0%, reflecting pricing to maintain existing margin structure and program changes with existing customers.

The outlook for Adjusted EBITDA growth and Adjusted diluted earnings per share reflect the following assumptions:

- Gross profit margin to remain consistent with the prior year as the expected decline in Jamieson Brands margins is offset by favourable customer and program mix impacting Strategic Partners. Jamieson Brands margins will be approximately 100 basis points lower impacted by the full year inclusion of youtheory and the transition to an owned distribution model in China;

- Normalized SG&A including marketing expenses are expected to increase 35.0% to 40.0% based on the acquisition of youtheory and an accelerated investment in marketing, resources and infrastructure to support long-term growth opportunities in the United States and in China;

- Based on the resource and marketing investments being made to drive long term growth, adjusted EBITDA margins are expected to decline by 175 basis points in 2023. The decline includes the margin profile of the acquired businesses and proportionate revenue growth within Strategic Partners;

- Interest expense of $17.5 to $18.5 million reflecting incremental debt to fund the acquisition and higher prevailing interest rates.

For additional details on the Company’s fiscal 2023 outlook, including guidance for the first quarter of 2023, refer to the “Outlook” section in the management’s discussion and analysis of financial condition and results of operations (“2022 MD&A”) for the three and twelve months ended December 31, 2022.

Declaration of Fourth Quarter Dividend

The board of directors of the Company authorized and declared a cash dividend for the fourth quarter of 2022 of $0.17 per common share, or approximately $7.1 million in the aggregate. The dividend will be paid on March 15, 2023 to all common shareholders of record at the close of business on March 3, 2023. The Company has designated this dividend as an “eligible dividend” for the Income Tax Act (Canada) purposes.