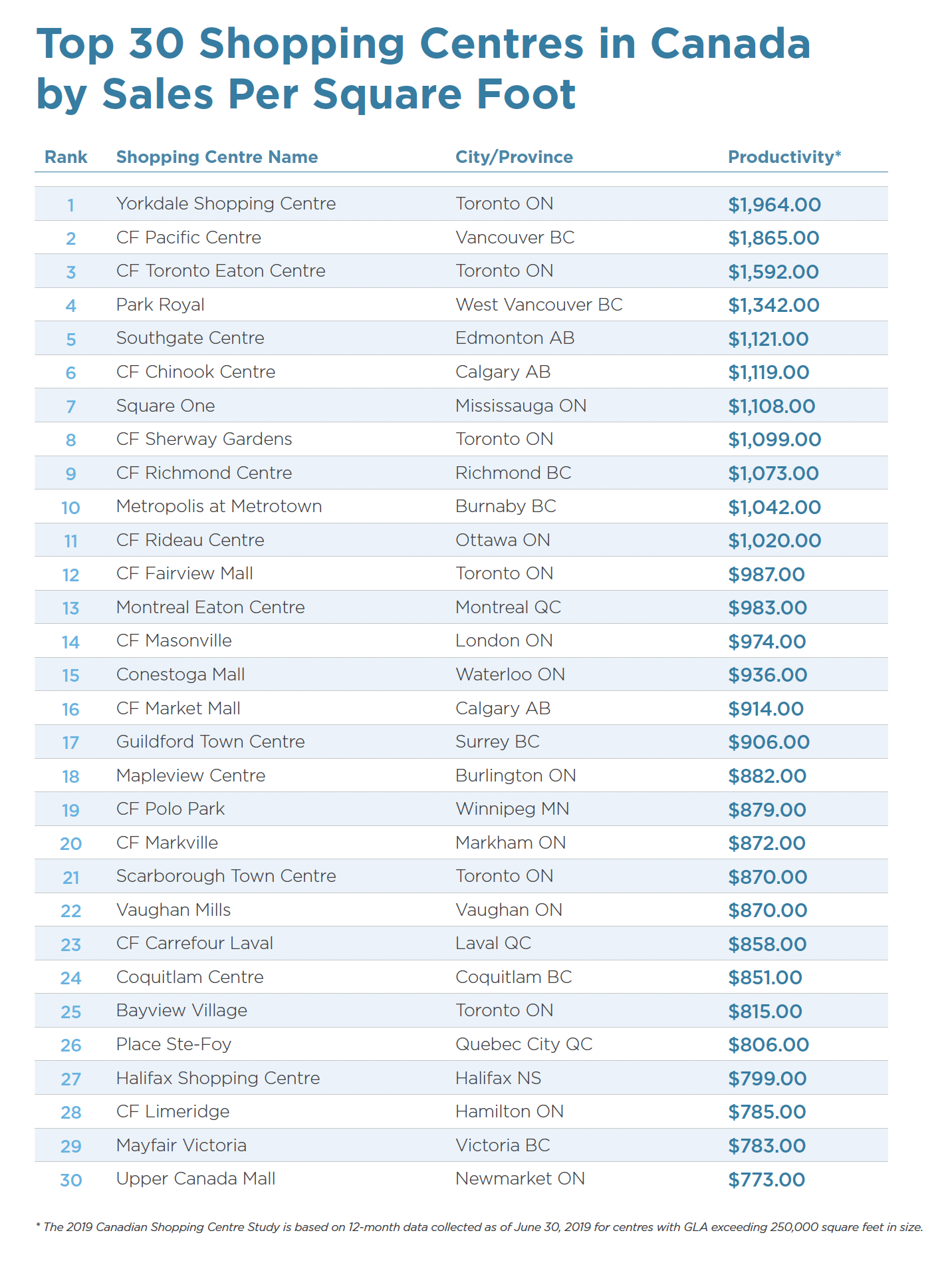

As of June 30, 2019, 11 shopping centres in Canada had annual average sales per square foot surpassing $1,000. Given growth projections for 2020, as many as 14 Canadian shopping centres could see their annual sales per square foot exceed $1,000. The top three most productive centres in Canada rely heavily on spending from out-of-town visitors.

Vancouver/Lower Mainland has more shopping centres per capita ranking among the top 30 most productive malls in Canada. While West Edmonton Mall did not make it into the top 30 rankings, its ‘centre run’ is highly productive and demonstrates the great potential for entertainment in shopping centres to drive both traffic and sales. Montreal Eaton Centre, which recently saw the merger of a smaller Eaton Centre property with an adjacent Complex Les Ailes, ranked in the study for the first time; the centre now exceeds 250,000 square feet. Of the top 30 ranked shopping centres, only five do not house Apple stores. It is estimated that if Apple were to locate in those centres (Park Royal, Montreal Eaton Centre, Scarborough Town Centre, Vaughan Mills, and Bayview Village) each could see an annual per square foot sales lift in excess of $100. Apple stores are reported to be the most productive stores in the world. Tesla showrooms also generate high annual sales per square foot. (Yorkdale Shopping Centre, Park Royal, and CF Sherway Gardens currently have Tesla stores) Known retail banners such as Aritzia and Lululemon can be found in most of the top 30 ranked shopping centres. While the suburbs are typically home to major shopping centres, four of the top shopping centres are in downtown cores (CF Toronto Eaton Centre, CF Pacific Centre, Montreal Eaton Centre, and CF Rideau Centre). This demonstrates the continued strength of Canada’s downtowns when compared to cities in the United States.

Many of the top centres are planning major additions including residential and office space in the next 5, 10, and 20 years. • Canadian shopping centre landlords are adding entertainment centres to existing properties to further drive traffic, recognizing the success of centres such as West Edmonton Mall. Ivanhoé Cambridge’s Vaughn Mills, for example, has announced a Cirque du Soleil family entertainment centre. Oxford Properties, which will announce two more entertainment centres for 2020, already has a major entertainment complex at its Galeries de la Capitale centre in Quebec City, a Dr. Seuss experience centre at Square One in Mississauga, as well as a butterfly-themed interactive centre called bFly at Quartier DIX30 in suburban Montreal. The bFly concept is directing further shopping centre expansion, according to its real estate partner Oberfeld Snowcap

While many of the top shopping centres have seen year-over-year gains, maintaining growth momentum is challenging in light of the impact online shopping has and continues to have on foot traffic. Landlords are therefore actively leveraging several strategies in tandem: securing the most profitable mix of retailers, phasing out underperforming tenants, adding novel attractions and keeping up with ongoing facility upgrades. Toronto’s Yorkdale Shopping Centre saw a 3.1% increase in annual sales per square foot in 2019 compared with the prior year. If Yorkdale sees just a 2% increase in 2020, it will surpass $2,000 per square foot annually – the new ‘high benchmark’ for shopping centres in Canada. In the United States, only a handful of centres have surpassed the $2,000 benchmark (in US Dollars), including Bal Harbour Shops in Florida, The Grove in Los Angeles, and the Mall at Rockingham Park in Salem New Hampshire. Park Royal in West Vancouver saw an incredible increase of 46.83% in annual sales per square in 2019 – the highest increase tracked over the past four years in this Retail Council of Canada study. Landlord Larco attributes the gain to increased foot traffic from a newly opened VIP Cineplex Cinema, highly productive retailers such as Tesla, and the addition of new retail tenants.

Vancouver’s CF Pacific Centre saw a substantial 10.36% increase largely driven by the addition of new retailers such as Canada Goose, as well as strong performance from existing retailers such as Harry Rosen. Nordstrom’s top-selling store in the entire chain is currently at CF Pacific Centre, though the retailer’s New York City flagship which opened October 24, 2019, is expected to surpass Vancouver’s numbers. Even with Calgary’s challenging economy, both CF Chinook Centre and CF Market Mall experienced productivity gains in 2019. Square One in Mississauga surpassed the annual sales per square foot benchmark of $1,100 for the first time. Landlord Oxford Properties noted that the centre saw a boost after the opening ‘The Food District’, The Rec Room and in the arrival of new retailers such as Uniqlo. CF Chinook Centre also surpassed the annual sales per square foot benchmark of $1,100 for the first time after adding retailers such as Louis Vuitton and Saks Fifth Avenue.