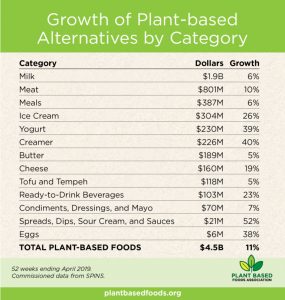

The U.S. market for plant-based foods hit the $5 billion mark in 2019, fueled by year-over-year sales growth of 11.4%, according to the Plant Based Foods Association (PBFA) and The Good Food Institute.

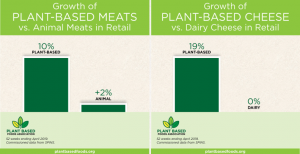

Plant-based food sales climbed five times faster than overall U.S. retail food sales, which rose 2.2% for 2019, PBFA and The Good Food Institute said Tuesday. Growth was slightly higher than in 2018, when sales of plant-based food increased 11% to $4.5 billion, compared with 2% growth for the total food retail market.

“Plant-based foods remain a growth engine, up 29% over the last two years,” Julie Emmett, senior director of retail partnerships at PBFA, said in a statement. “Growth is fueled by innovation in categories across the store, and retailers are responding by expanding shelf space to satisfy the rapidly expanding consumer base seeking more plant-based foods.”

Among plant-based food categories with sales of at least $100 million in 2019, the biggest gainers were creamer (+34.3%), yogurt (+31.3%), meat (+18.4%), ready-to-drink beverages (+18.4%) and cheese (+18.3%). Milk, meat, dairy alternatives and meals remain the largest plant-based food segments and continue to be the top sales drivers, PBFA noted.

By far, the biggest category is plant-based milk, which last year tallied sales of $2 billion, up 5%. Plant-based milk sales now account for 14% of the entire milk category, PBFA said, adding that cow’s milk sales were almost flat in 2019.

Rounding out the 10 largest plant-based food categories in 2019 were meat ($939 million), meals ($377 million), ice cream ($336 million), creamer ($287 million), yogurt ($283 million), butter ($198 million), cheese ($189 million), tofu and tempeh ($128 million) and ready-to-drink beverages ($122 million).

The 18.4% sales growth in plant-based meat topped the category’s 2018 growth of 10%. PBFA said refrigerated plant-based meat is fueling the segment’s expansion, with sales growth of 63% in 2019. Plant-based meat now represents 2% of retail packaged meat sales, the association reported. Conventional meat sales rose 3% in 2019.

PBFA said plant-based dairy categories are expanding as these items are introduced to more households, whereas sales of many conventional animal-based dairy products have remained flat or declined.

For example, conventional yogurt sales fell 1% (versus 31.3% for plant-based yogurt), while conventional cheese sales edged up 1% (versus 18.3% for plant-based cheese). Also, with sales growth of over 34% in 2019, plant-based creamers saw its share of the overall creamers market rise to 5% from 4% in 2018.

Several smaller plant-based categories also saw robust growth in 2019, including plant-based eggs (+191.7% to $10 million); plant-based spreads, dips, sour cream and sauces (+53.7% to $30 million); and plant-based condiments, dressings and mayonnaise (+10.9% to $64 million).

“Clearly, plant-based is a lasting trend that is gaining power over time. We see a steady rise in plant-based products year over year across regions, which indicates that this is not a bubble or a fad, but a real change in consumer behavior. This is a tipping point, with so much product innovation yet to hit the market,” commented Caroline Bushnell, associate director of corporate engagement a The Good Food Institute.

“Shifting consumer values have created a favourable market for plant-based foods, which have significantly outpaced overall grocery sales increases for three years running, making plant-based foods a growth engine for both manufacturers and retailers,” Bushnell said. “This is really only the beginning. Plant-based foods will continue to expand rapidly across the store in response to demand as consumers increasingly switch to foods that match their changing values and desire for more sustainable options. We expect further acceleration in 2020.”

Credit: Supermarket News. By: Russell Redman