Natural Grocers by Vitamin Cottage, Inc. (NYSE: NGVC) announced results for its third quarter of fiscal 2022 ended June 30, 2022 and refined its outlook for fiscal 2022.

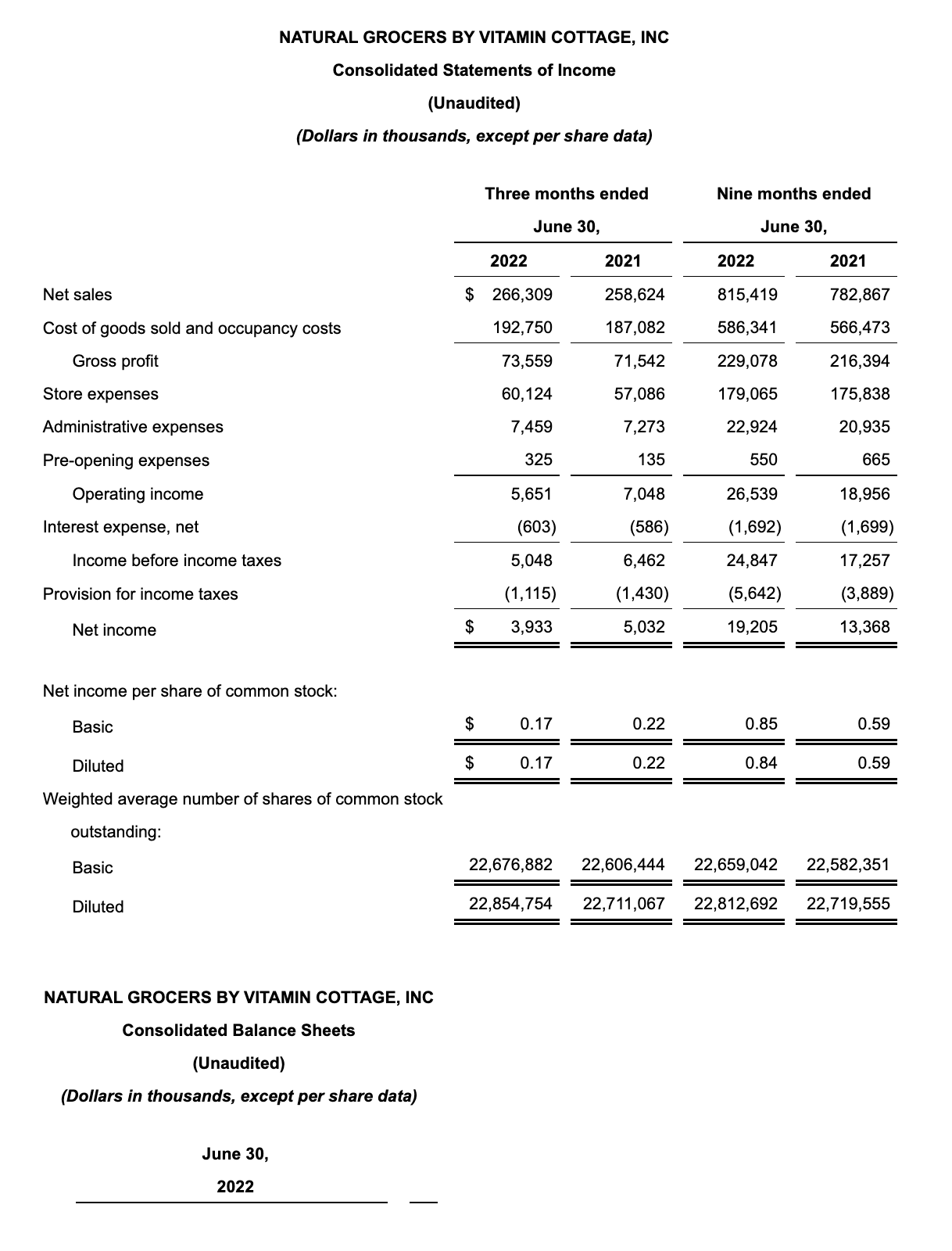

- Net sales increased 3.0% to $266.3 million;

- Daily average comparable store sales increased 2.5%;

- Operating income was $5.7 million;

- Net income was $3.9 million with diluted earnings per share of $0.17; and

- Adjusted EBITDA was $13.0 million.

“We are pleased with our results in the third quarter, which were in-line with our expectations,” said Kemper Isely, Co-President. “Consumers continue to be drawn to the quality and value of our offering, along with our convenient shopping experience, making us a leading destination for natural and organic products in our markets. Since the third quarter of fiscal 2019 our daily average comparable store sales have increased 14.1% and diluted earnings per share have grown 88.9%, underscoring the strength of our differentiated model as well as our emphasis on operational excellence. We remain confident in our fiscal 2022 outlook and continue to focus on driving profitable growth and enhancing shareholder value.”

In addition to presenting the financial results of Natural Grocers by Vitamin Cottage, Inc. and its subsidiaries (collectively, the Company) in conformity with U.S. generally accepted accounting principles (GAAP), the Company is also presenting EBITDA and Adjusted EBITDA, which are non-GAAP financial measures. The reconciliation from GAAP to these non-GAAP financial measures is provided at the end of this earnings release.

During the third quarter of fiscal 2022, net sales increased $7.7 million, or 3.0%, to $266.3 million, compared to the third quarter of fiscal 2021, due to a $6.4 million increase in comparable store sales and a $2.1 million increase in new store sales, partially offset by a $0.8 million decrease in sales from one store that closed at the beginning of the quarter. Daily average comparable store sales increased 2.5% in the third quarter of fiscal 2022, and was comprised of a 2.7% increase in daily average transaction size, partially offset by a 0.2% decrease in daily average transaction count. The increase in net sales was primarily driven by retail price inflation, our customers’ response to pandemic trends, marketing initiatives, promotional campaigns and increased engagement in our {N}power® customer loyalty program.

Gross profit during the third quarter of fiscal 2022 increased 2.8% to $73.6 million, driven by increased sales volume. Gross profit reflects earnings after product and occupancy expenses. Gross margin decreased 10 basis points to 27.6% during the third quarter of fiscal 2022, compared to the third quarter of fiscal 2021. The decrease in gross margin was primarily driven by lower product margin attributed to higher freight, distribution and shrink expenses, partially offset by store occupancy leverage.

Store expenses during the third quarter of fiscal 2022 increased 5.3% to $60.1 million. Store expenses as a percentage of net sales was 22.6% during the third quarter of fiscal 2022, up from 22.1% in the third quarter of fiscal 2021. The increase in store expenses as a percentage of net sales was primarily driven by higher labor expense as a result of increased wage rates.

Administrative expenses during the third quarter of fiscal 2022 increased 2.6% to $7.5 million. Administrative expenses as a percentage of net sales were 2.8% for each of the third quarters of fiscal 2022 and 2021.

Operating income for the third quarter of fiscal 2022 was $5.7 million, compared to $7.0 million in the third quarter of fiscal 2021. Operating margin during the third quarter of fiscal 2022 decreased to 2.1%, compared to 2.7% in the third quarter of fiscal 2021.

Net income for the third quarter of fiscal 2022 was $3.9 million, or $0.17 diluted earnings per share, compared to net income of $5.0 million, or $0.22 diluted earnings per share for the third quarter of fiscal 2021.

Adjusted EBITDA was $13.0 million in the third quarter of fiscal 2022, compared to $14.6 million in the third quarter of fiscal 2021.

During the first nine months of fiscal 2022, net sales increased $32.6 million, or 4.2%, to $815.4 million, compared to the first nine months of fiscal 2021, due to a $27.6 million increase in comparable store sales and a $5.8 million increase in new store sales, partially offset by a $0.8 million decrease in sales from one store that closed at the beginning of the third quarter of fiscal 2022. Daily average comparable store sales increased 3.5% in the first nine months of fiscal 2022, and was comprised of a 2.0% increase in daily average transaction size and a 1.5% increase in daily average transaction count. The increase in net sales was primarily driven by our customers’ response to pandemic trends, retail price inflation, marketing initiatives, promotional campaigns, and increased engagement in our {N}power® customer loyalty program.

Gross profit during the first nine months of fiscal 2022 increased 5.9% to $229.1 million, primarily driven by increased sales volume. Gross profit reflects earnings after product and occupancy expenses. Gross margin increased 50 basis points to 28.1% during the first nine months of fiscal 2022, compared to the first nine months of fiscal 2021. The increase in gross margin was primarily driven by improved product margin and store occupancy leverage.

Store expenses during the first nine months of fiscal 2022 increased 1.8% to $179.1 million. Store expenses as a percentage of net sales was 22.0% during the first nine months of fiscal 2022, down from 22.5% in the first nine months of fiscal 2021. The reduction in store expenses as a percentage of net sales reflects leverage attributed to higher sales and a more normalized operating environment compared to the prior fiscal year period.

Administrative expenses during the first nine months of fiscal 2022 increased 9.5% to $22.9 million. Administrative expenses as a percentage of net sales was 2.8% during the first nine months of fiscal 2022, up from 2.7% in the first nine months of fiscal 2021.

Operating income for the first nine months of fiscal 2022 was $26.5 million, compared to $19.0 million in the first nine months of fiscal 2021. Operating margin during the first nine months of fiscal 2022 increased to 3.3%, compared to 2.4% in the first nine months of fiscal 2021.

Net income for the first nine months of fiscal 2022 was $19.2 million, or $0.84 diluted earnings per share, compared to net income of $13.4 million, or $0.59 diluted earnings per share for the first nine months of fiscal 2021.

Adjusted EBITDA was $48.6 million in the first nine months of fiscal 2022, compared to $42.5 million in the first nine months of fiscal 2021.

As of June 30, 2022, the Company had $19.9 million in cash and cash equivalents, no outstanding borrowings on its $50.0 million revolving credit facility, and $17.7 million outstanding on its term loan facility.

During the first nine months of fiscal 2022, the Company generated $29.5 million in cash from operations and invested $18.0 million in net capital expenditures, primarily for new and relocated/remodeled stores.

Today, the Company announced the declaration of a quarterly cash dividend of $0.10 per common share. The dividend will be paid on September 14, 2022 to stockholders of record at the close of business on August 29, 2022.

During the third quarter of fiscal 2022 the Company opened one new store in Colorado, ending the quarter with 162 stores in 20 states. Since June 30, 2022, the Company opened one new store in South Dakota. As of August 4, 2022, the Company has signed leases for an additional five new stores planned to open in fiscal years 2022 and beyond.

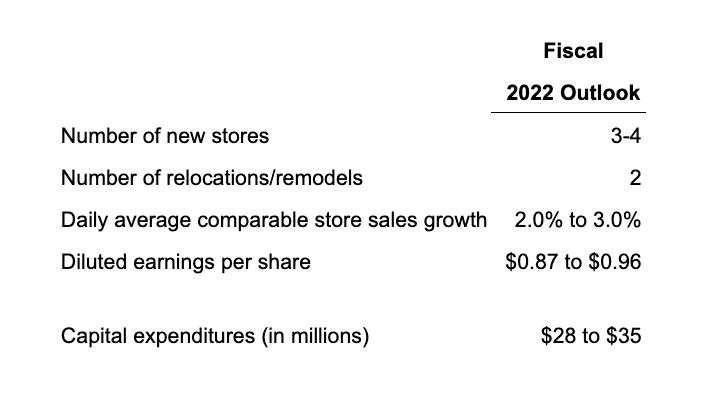

The Company is refining its fiscal 2022 new store openings, comparable store sales and earnings per share outlook based upon year-to-date performance and current trends, as well as the uncertainty of the pandemic, and economic and inflationary factors. The Company now expects:

The following constitutes a “safe harbor” statement under the Private Securities Litigation Reform Act of 1995. Except for the historical information contained herein, statements in this release are “forward-looking statements” and are based on current expectations and assumptions that are subject to risks and uncertainties. All statements that are not statements of historical fact are forward-looking statements. Actual results could differ materially from those described in the forward-looking statements because of factors such as risks and challenges related to the pandemic and government mandates, the economy, inflationary and deflationary trends, periods of recession, changes in the Company’s industry, business strategy, goals and expectations concerning the Company’s market position, future operations, margins, profitability, capital expenditures, liquidity and capital resources, future growth, the war in Ukraine, other financial and operating information and other risks detailed in the Company’s Annual Report on Form 10-K for the fiscal year ended September 30, 2021 (the Form 10-K) and the Company’s subsequent quarterly reports on Form 10-Q. The information contained herein speaks only as of the date of this release and the Company undertakes no obligation to update forward-looking statements, except as may be required by the securities laws.

For further information regarding risks and uncertainties associated with the Company’s business, please refer to the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Risk Factors” sections of the Company’s filings with the Securities and Exchange Commission, including, but not limited to, the Form 10-K and the Company’s subsequent quarterly reports on Form 10-Q, copies of which may be obtained by contacting Investor Relations at 303-986-4600 or by visiting the Company’s website at http://Investors.

Investor Contact:

Reed Anderson, ICR, 646-277-1260, reed.anderson@