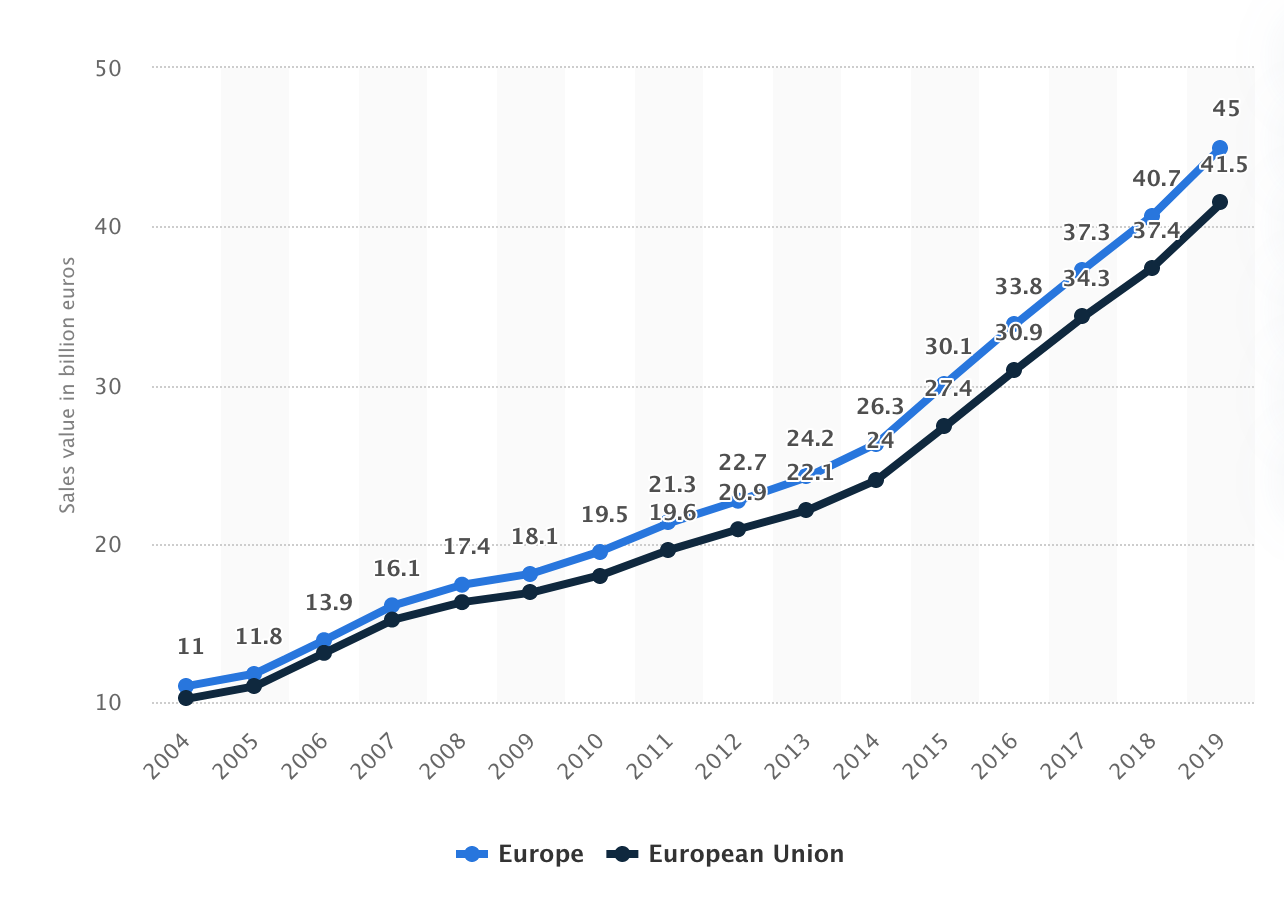

Organic retail sales in 2019 came to approximately 41.5 billion euros in the European Union and 45 billion in Europe. In both cases, an increase could be observed over the entire period. An annual increase was seen between 2004 and 2019 for both regions with a steep acceleration of growth, beginning around 2014. Retail sales of organic food in Germany amounted to approximately eleven billion in 2019. The second biggest market measured in retail sales was France

Per capita consumption

Per capita spending on organic food in the EU-28 reached 84 euros per person. The highest spending on organic food could be observed in the Alps and in the North of the continent. In Switzerland and Denmark, per capita, spending reached 338 and 312 euros in 2019, respectively. Sweden came in second and third with a spending of 231 euros.

Sales in Germany and the UK

The German market has seen a continuous upward trend in sales since the year 2000 barring only the year 2009. The dip was likely caused by the financial crisis. In contrast, UK sales suffered immensely in 2008 and the following years. The loss in sales was so heavy that the market needed until 2017 to generate more sales than were generated in 2007.

Organic retail sales value in the European Union and Europe from 2004 to 2019

Even though sales are booming, the state of organic production is yet to catch up with demand: organic farmland as a proportion of all farmland area rarely exceeds 15 percent in the majority of countries. Similarly, organic meat production is only a minuscule share of overall livestock, particularly in the case of pork at only 0.6 percent. Nevertheless, arable organic crop production in Europe is centred around cereals, while permanent crops are predominantly made up of olives and grapes.

Although Germany has the largest market for organic food, the highest levels of per capita consumption can be found in Switzerland and the Nordic countries. European consumers have high levels of awareness for organic claims at 61 percent, with a further 11 percent actively seeking such products. Furthermore, increasing numbers are buying more organic food and drink products, with a relatively equal proportion willing to pay a premium for an organic claim. Avenues for purchase tend to be general retailers or specialized organic retailers, while the appeal of various products differs between countries: the United Kingdom has the largest market for organic fish, for instance, whereas organic confectionery launches are concentrated in Germany.

Health and wellness have been one of the defining trends for the food and drink industry for years and European continue to care deeply about what they eat and drink. In Great Britain, the second most common reason for becoming a vegan or vegetarian is that such a diet is perceived as being more healthy. Brits who follow a diet with reduced meat intake think of themselves as healthy eaters more often. Due to the high consumer demand for meat-free alternatives, the industry for meat substitutes has grown by over 350 million U.S. dollars between 2015 and 2018, and further growth is expected. Grain-based substitutes had the highest market share, closely followed by soy-based products.

Sugar content

Meat is not the only item on the chopping block of the more health-conscious consumer. In 2018, soft drink juggernaut Coca-Cola made more than 10 billion U.S. dollars from the retail sale of carbonated beverages with reduced sugar content in Europe. The United Kingdom, Germany and Spain have become sizeable multi-billion-dollar markets for these products. However, not only are shoppers looking to increase their consumption of drinks with less sugar, but also of food products with reduced sugar content. Mars Incorporated leads the European market for confectionery with less sugar, while artisanal and private label products massively shape the bakery and cereal product market.

Protein market

However, European are not only looking to cut back on certain ingredients or items but also look to add. One of the nutrients that are currently in favour is protein. All over Europe, shoppers spent the equivalent of hundreds of British pounds on protein shakes and high-protein foods and snacks. Interest in plant-based sources is especially high. The industry expects the growth of plant-based products to amount to hundreds of thousands of metric tons in coming years in Europe and Russia. Besides protein from plants, another protein source is expected to become more and more relevant. Insect protein is expected to reach a production volume of 1.2 million tons in 2025 for human and animal consumption.