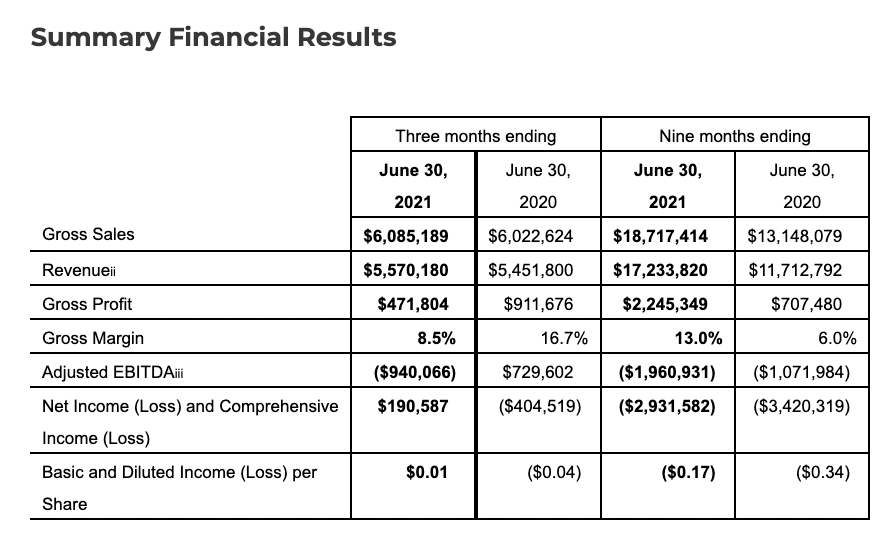

- Gross Sales of $6.1 million in Q3 2021; Gross Sales of $18.7 million in the first nine months of 2021, +42.4% compared to the same period in 2020.

- Gross Margini of 8.5% in Q3 2021; Gross Margin of 13.0% in the first nine months of 2021, +699bps vs. the same period in 2020.

- Continued to grow distribution footprint, including the introduction of Sol Cuisine products in all Costco Mexico stores during Q4, and the launch of four of the Company’s SKUs nationally in Walmart Canada stores and on Walmart.ca, which was announced this morning.

- Continued progress against key strategic pillars, including expanded distribution in existing channels and new channels; The Company launched its initial e-commerce capabilities during Q4.

Management Commentary

John Flanagan, CEO of Sol Cuisine commented, “During the first nine months of 2021, our team made significant strides against all four pillars of our strategy designed to generate sustainable growth. Despite more muted growth in Q3 due to lower industry-wide sales in the retail and club channels as consumer demand patterns adjusted to a post-COVID world, Sol Cuisine generated more than 40% growth in gross sales in the first nine months of the year, and a roughly 700 basis point improvement in gross margin.”

Mr. Flanagan continued, “Since the time of our public listing, we have deepened our distribution reach and relationships with top retailers such as Metro, Sobeys, Loblaw Companies and Costco, and launched in a new country with one of those partners – Costco – which is now carrying Sol Cuisine products in all of their stores in Mexico. This morning, we announced that four Sol Cuisine products will be launched across approximately 200 stores and through Walmart.ca in Canada, this September. From an operating perspective we are firing on all cylinders, and we expect our efforts to get our delicious, nutritionally superior offerings into the hands of more consumers will generate both volume growth and steady margin expansion as we ramp up production at our fully built-out production facilities.”

Review of Execution of Growth Strategy

Sol Cuisine is focused on executing a clear and actionable strategy designed to deliver continued growth. This strategy is focused on four primary pillars: introducing breakthrough product innovation; generating brand velocity; aggressively expanding retail distribution; and launching and growing in important new channels. The Company continued to make progress during the quarter, with successes including:

- Breakthrough product innovation: In the quarter, the Company launched appetizers and entrees in a bagged format which has received favourable initial reception by consumers. The Company continues to innovate and create exciting new SKUs that complement existing protein formats.

- Brand velocity: In the quarter, the Company grew brand velocity by focusing on promotional partnerships with key national grocery retailers. The Company’s Sol Cuisine wings, meatballs, Turk’y Roasts and Chik’n tenders have performed well, already exceeding the velocity exhibited by the Company’s leading burger products. The introduction of Falafel, Chik’n Bites, Chik’n Tenders, Meatballs and Wings in the U.S. are also selling ahead of expectations. The Company has multiple campaigns launching over the next two quarters with retail partners to drive brand equity.

- Distribution footprint: In the quarter, the Company added products through Canadian retail banners including: Loblaws, Sobeys, Costco, Farm Boy and Whole Foods. In the U.S. the Company added products through retail banners including: Weis, Tops and Club Foods. The Company is engaged in discussions to add additional retailers in both Canada and the U.S.

- Launch and growth in important new channels: The Company continued to grow its presence in the key U.S. Club and Food Service segments with launches and/or expansions in Costco (Midwest region), Publix, Little Spoon and Target Deli. In early Q4, Sol Cuisine announced the launch of its initial e-commerce capabilities, which will enable customers to locate and purchase products directly through several leading grocery platforms.

Summary of Recent Corporate Developments

- On August 19, 2021, the Company announced a new distribution agreement with National Co+op Grocers (NCG) in the U.S. to sell a selection from the Company’s line of plant-based Bites appetizers. Sol Cuisine’s Crispy Chik’n Bites and Spinach Chickpea Bites are available across NCG’s 200 stores in 39 states. This is the Company’s first distribution agreement with NCG which has combined annual sales over $2.3 billion and more than 1.3 million consumer-owners.

- On August 11, 2021, the Company announced the launch of one of its most popular SKUs – Buffalo Cauliflower Chik’n Wings – in all 39 Costco stores in Mexico. This is the first time that Sol Cuisine products have been offered in the Mexican market. The products were launched on-shelf beginning August 23rd.

- On August 5, 2021, Sol Cuisine announced that it had appointed experienced financial leader Adam Kozak, as Chief Financial Officer of the Company. Mr. Kozak succeeds David McLaren and assumed the role on August 9, 2021. Mr. McLaren continues to provide support through a transitional period. Mr. Kozak has over 20 years of experience in Finance, M&A Integration, and Investor Relations in both established and emerging industries. Most recently he held the role of CFO for a privately held group of direct store delivery, warehousing, and logistics companies. While holding the role of CFO at TerrAscend Corp. Adam led the Company through several of its key milestones, including the successful completion of TerrAscend’s capital reorganization and structuring and executing the Company’s milestone M&A transactions that laid the foundation for entering into the U.S. market becoming a leading North American operator. Prior to joining TerrAscend Adam spent over 10 years at Loblaw Companies Limited where he held progressive roles in Finance, Investor Relations, M&A Integration, Loyalty and Consumer Insights.

- On July 30, 2021, the Company announced it was launching the first of multiple planned national freezer bunker programs with Sobeys featuring 7 SKUs across its grocery stores with a focus on Ontario, British Columbia, Alberta and Nova Scotia. The program featured Sol Cuisine’s Hot & Spicy Chik’n Wings, Crispy Chik’n Tenders, Crispy Tempura Filets, Zesty Italian Style Meatballs, Crispy Chik’n Bites, Spinach Chickpea Bites and Spicy Black Bean Bites.

- On July 14, 2021, Sol Cuisine announced it had launched initial e-commerce capabilities in partnership with Destini™ Global, LLC (“Destini”), a leading provider of digital solutions to innovative CPG brands in North America, underpinned by a powerful store-level database and tool set. Available at solcuisine.com, these initial capabilities include: a product locator, to help customers locate Sol Cuisine products in nearby stores; and an e-commerce link to eight established sites where customers can purchase Sol Cuisine products directly. In Canada, solcuisine.com will link to: Voila, Loblaws, Instacart, Real Canadian Superstore, Safeway, SaveonFoods, Maxi, Cornershop, and Vejii. In the U.S., solcuisine.com will link to: Instacart, Cornershop, and Vejii. In addition to these consumer-facing capabilities, the Destini platform includes a robust suite of consumer demand analytics, which will enable Sol Cuisine to map consumer interest, track search results and match the launch of new or additional SKUs in areas that align with consumer demand based on hard data.

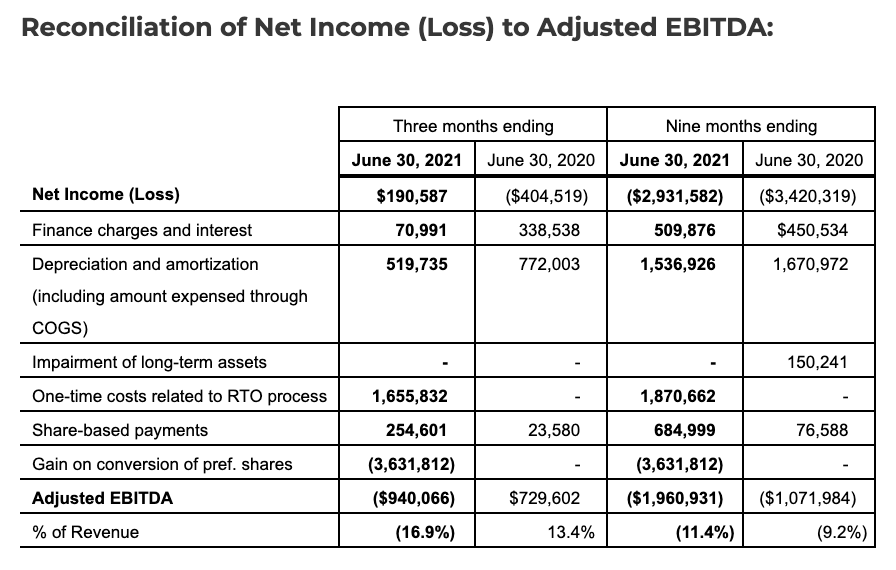

Non-IFRS Financial Measures

Adjusted EBITDA and Adjusted EBITDA Margin

Adjusted EBITDA and adjusted EBITDA margin are both non-IFRS financial measures. Adjusted EBITDA is defined as net income or loss before income taxes, net finance costs, depreciation and amortization, impairment losses, restructuring costs, one-time cost related to going public and stock-based compensation, while adjusted EBITDA margin is defined as the percentage of adjusted EBITDA to revenue. We believe that adjusted EBITDA and adjusted EBITDA margin are useful measures of financial performance because they provide an indication of the Company’s ability to seize growth opportunities in a cost-effective manner, finance its ongoing operations and service its long-term debt.

The following information provides reconciliations of the supplemental non-IFRS financial measure presented herein to the most directly comparable financial measure calculated and presented in accordance with IFRS.