METRO INC. announced its results for the third quarter of fiscal 2022 ended July 2, 2022.

2022 THIRD QUARTER HIGHLIGHTS

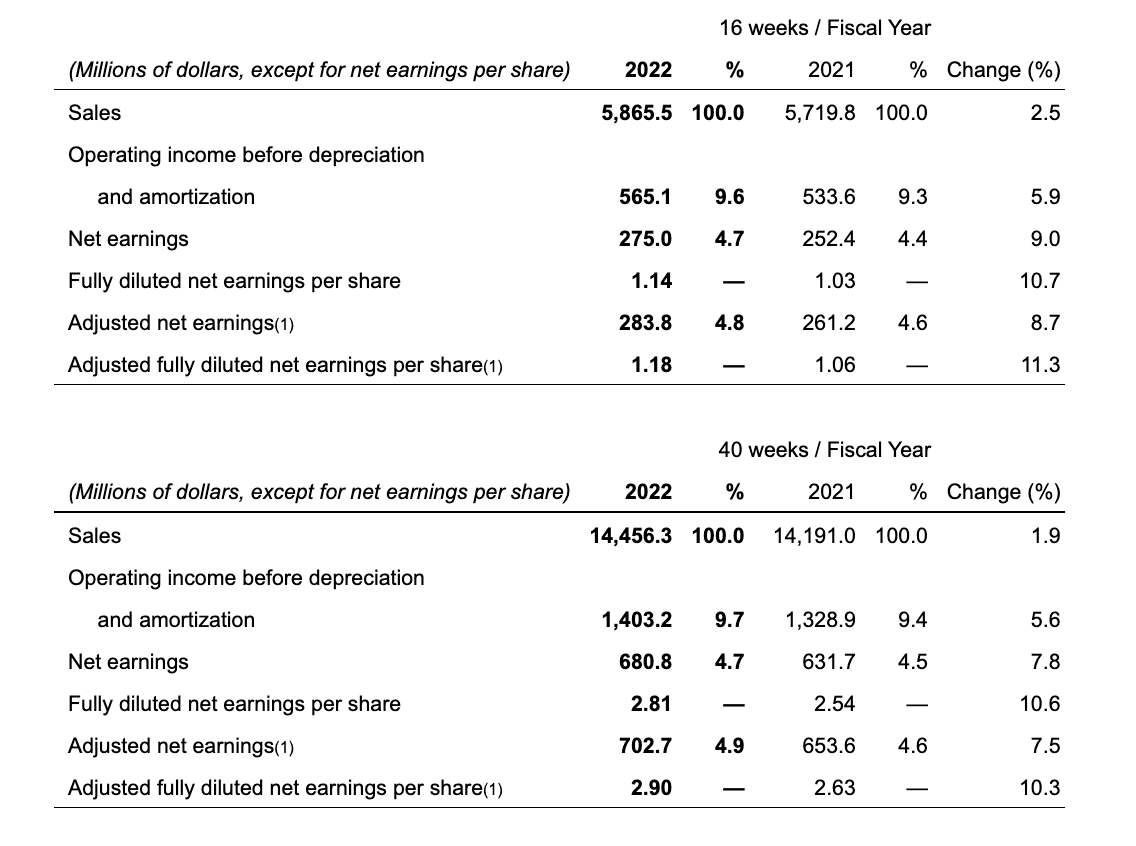

- Sales of $5,865.5 million, up 2.5%

- Food same-store sales up 1.1%

- Pharmacy same-store sales up 7.2%

- Net earnings of $275.0 million, up 9.0% and adjusted net earnings(1) of $283.8 million, up 8.7%

- Fully diluted net earnings per share of $1.14, up 10.7%, and adjusted fully diluted net earnings per share(1)

of $1.18, up 11.3%

SALES

Sales in the third quarter of Fiscal 2022 remained strong, reaching $5,865.5 million, up 2.5% versus elevated sales in the third quarter of 2021 due to the pandemic. Food same-store sales were up 1.1% (down 3.6% in 2021) versus the same quarter last year. Online food sales were flat versus last year (up 19.0% in 2021). Our food basket inflation was about 8.5% (5.0% in the previous quarter). Pharmacy same-store sales were up 7.2% (7.6% in 2021), with a 5.6% increase in prescription drugs supported by COVID-related activities such as the distribution of rapid tests and a 10.7% increase in front-store sales, primarily driven by over-the-counter products and cosmetics.

Sales in the first 40 weeks of Fiscal 2022 totalled $14,456.3 million, up 1.9% compared to $14,191.0 million for the corresponding period of 2021.

OPERATING INCOME BEFORE DEPRECIATION AND AMORTIZATION

This earnings measurement excludes financial costs, taxes, depreciation and amortization.

Operating income before depreciation and amortization for the third quarter of Fiscal 2022 totalled $565.1 million, or 9.6% of sales, an increase of 5.9% versus the corresponding quarter of Fiscal 2021. Included in the third quarter of Fiscal 2022 are $7.7 million of direct costs related to the one-week labour conflict and new collective agreement ratification with our distribution center employees in Toronto offset by a non-recurring gain on the sale of assets of $8.7 million ($5.1 million in 2021). Operating income before depreciation and amortization for the first 40 weeks of Fiscal 2022 totalled $1,403.2 million or 9.7% of sales, up 5.6% versus the corresponding period of 2021.

Gross margin on sales for the third quarter and the first 40 weeks of Fiscal 2022 were 19.8% and 19.9% respectively, the same percentages as the corresponding periods of 2021. A slight decline in our food division margin in the third quarter was compensated by a stronger pharmacy performance. The gross margin for the third quarter of Fiscal 2022 also included $5.3 million of direct costs related to the one-week labour conflict with our distribution center employees in Toronto.

Operating expenses as a percentage of sales for the third quarter of Fiscal 2022 were 10.1% versus 10.5% for the corresponding quarter of 2021 mainly due to the reduction in COVID-related costs. Operating expenses for the third quarter of Fiscal 2022 were impacted by $2.4 million of direct costs related to the one-week labour conflict and new collective agreement ratification with our distribution center employees in Toronto offset by a non-recurring gain on the sale of assets of $8.7 million ($5.1 million in 2021). For the first 40 weeks of Fiscal 2022, operating expenses as a percentage of sales were 10.2% versus 10.5% in 2021.

DEPRECIATION AND AMORTIZATION AND NET FINANCIAL COSTS

Total depreciation and amortization expense for the third quarter of Fiscal 2022 was $154.7 million versus $149.4 million for the corresponding quarter of 2021. This increase reflects the additional investments in supply chain and logistics as well as in-store technology. For the first 40 weeks of Fiscal 2022, total depreciation and amortization expenses were $383.5 million versus $367.5 million for the corresponding period of 2021.

Net financial costs for the third quarter of Fiscal 2022 were $35.8 million compared with $42.1 million for the corresponding quarter of 2021. For the first 40 weeks of Fiscal 2022, net financial costs were $92.3 million compared with $104.8 million for the corresponding period of 2021. The reduction is mainly due to lower debt, lower borrowing rates on new debt and higher capitalized interest.

INCOME TAXES

The income tax expense of $99.6 million for the third quarter of Fiscal 2022 represented an effective tax rate of 26.6% compared with an income tax expense of $89.7 million and an effective tax rate of 26.2% in the third quarter of Fiscal 2021. The 40-week period income tax expense of $246.6 million for Fiscal 2022 and $224.9 million for Fiscal 2021 represented an effective tax rate of 26.6% and 26.3% respectively.

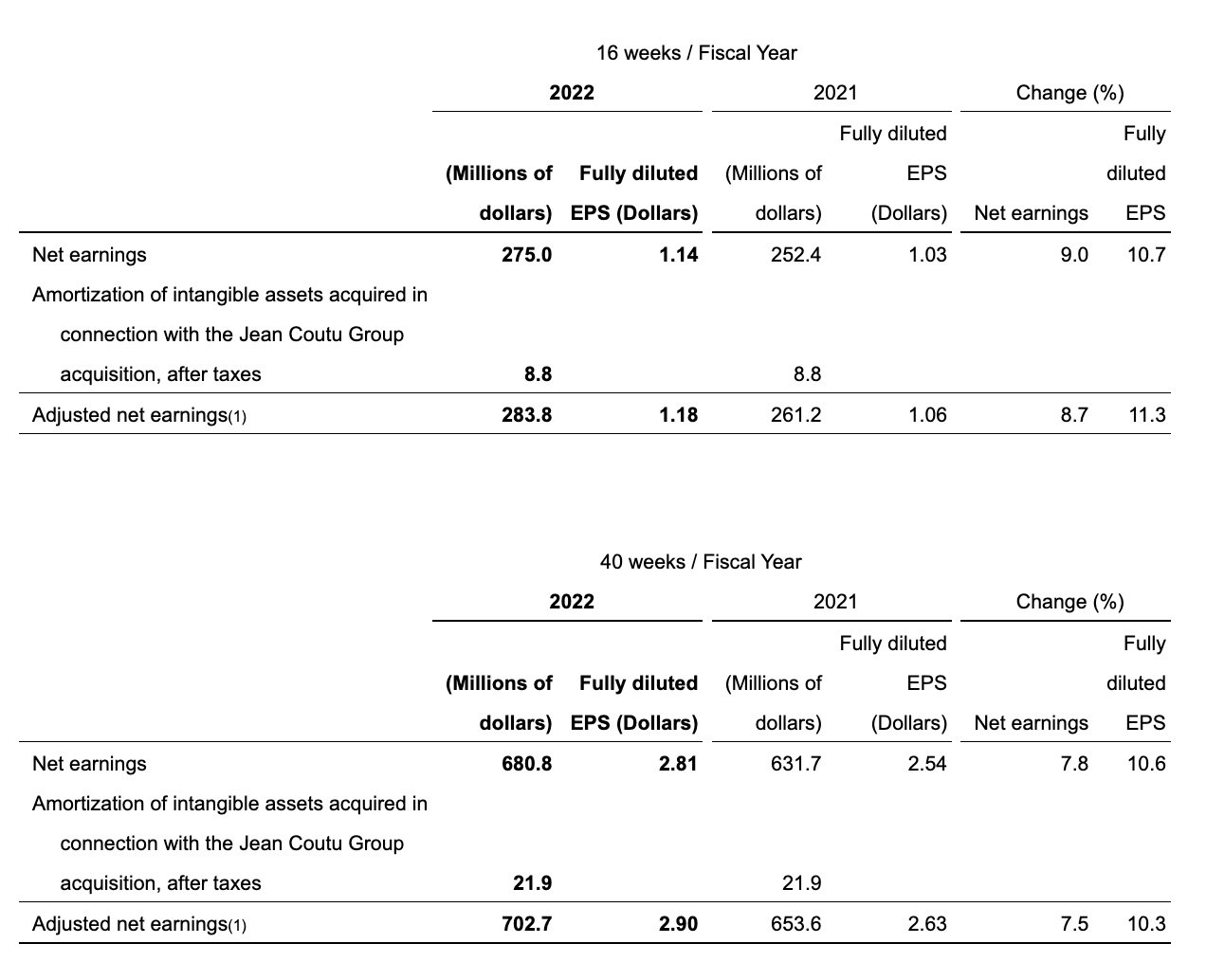

NET EARNINGS AND ADJUSTED NET EARNINGS(1)

Net earnings for the third quarter of Fiscal 2022 were $275.0 million compared with $252.4 million for the corresponding quarter of 2021, while fully diluted net earnings per share were $1.14 compared with $1.03 in 2021, up 9.0% and 10.7% respectively. Excluding the specific item shown in the table below, adjusted net earnings(1) for the third quarter of Fiscal 2022 totalled $283.8 million compared with $261.2 million for the corresponding quarter of 2021, and adjusted fully diluted net earnings per share(1) amounted to $1.18 versus $1.06, up 8.7% and 11.3% respectively.

Net earnings for the first 40 weeks of Fiscal 2022 were $680.8 million compared with $631.7 million for the corresponding period of 2021, while fully diluted net earnings per share were $2.81 compared with $2.54 in 2021, up 7.8% and 10.6%, respectively. Excluding the specific item shown in the table below, adjusted net earnings(1) for the first 40 weeks of Fiscal 2022 totalled $702.7 million compared with $653.6 million for the corresponding period of 2021, and adjusted fully diluted net earnings per share(1) amounted to $2.90 versus $2.63, up 7.5% and 10.3%, respectively.

Net earnings adjustments(1)

NORMAL COURSE ISSUER BID PROGRAM

Under the current normal course issuer bid program, the Corporation may repurchase up to 7,000,000 of its Common Shares between November 25, 2021, and November 24, 2022. Between November 25, 2021, and July 29, 2022, the Corporation repurchased 3,800,000 Common Shares at an average price of $67.38, for a total consideration of $256.0 million.

DIVIDENDS

On August 9, 2022, the Board of Directors declared a quarterly dividend of $0.275 per share, the same amount declared last quarter.

FORWARD-LOOKING INFORMATION

We have used, throughout this report, different statements that could, within the context of regulations issued by the Canadian Securities Administrators, be construed as being forward-looking information. In general, any statement contained herein that does not constitute a historical fact may be deemed a forward-looking statement. Expressions such as “predict”, “expect” and other similar expressions are generally indicative of forward-looking statements. The forward-looking statements contained herein are based upon certain assumptions regarding the Canadian food and pharmaceutical industries, the general economy, our annual budget, as well as our 2022 action plan.

These forward-looking statements do not provide any guarantees as to the future performance of the Corporation and are subject to potential risks, known and unknown, as well as uncertainties that could cause the outcome to differ significantly. The arrival of a new competitor is an example of the risks described under the “Risk Management” section of the 2021 Annual Report which could have an impact on these statements. As with the preceding risks, the COVID-19 pandemic constitutes a risk that could have an impact on the business, operations, projects and performance of the Corporation as well as on the forward-looking statements contained in this document.

We believe these statements to be reasonable and pertinent as at the date of publication of this report and represent our expectations. The Corporation does not intend to update any forward-looking statement contained herein, except as required by applicable law.

NON-IFRS MEASUREMENTS

In addition to the International Financial Reporting Standards (IFRS) earnings measurements provided, we have included certain non-IFRS earnings measurements. These measurements are presented for information purposes only. They do not have a standardized meaning prescribed by IFRS and therefore may not be comparable to similar measurements presented by other public companies.

ADJUSTED OPERATING INCOME BEFORE DEPRECIATION AND AMORTIZATION, ADJUSTED NET EARNINGS AND ADJUSTED FULLY DILUTED NET EARNINGS PER SHARE

Adjusted operating income before depreciation and amortization, adjusted net earnings and adjusted fully diluted net earnings per share are earnings measurements that exclude some items that must be recognized under IFRS. They are non-IFRS measurements. We believe that presenting earnings without these items, which are not necessarily reflective of the Corporation’s performance, leaves readers of financial statements better informed as to the current period and corresponding prior year’s period’s operating earnings, thus enabling them to better perform trend analysis, evaluate the Corporation’s financial performance and judge its future outlook. The exclusion of these items does not imply that they are non-recurring.

OUTLOOK(2)