Loblaw delivered strong operational and financial results as it continued to execute on retail excellence in its core businesses while advancing its growth and efficiencies initiatives. Drug Retail performance continued to drive overall margin expansion, as sales benefited from growth in higher margin front-store categories.

The positive trend in Food Retail continued with the Company’s conventional stores performing well relative to peers and sales growth in its discount banners, heightened by the strength of the No Frills® and Maxi® hard-discount stores and the Company’s value-focused control brand no name®.

“Loblaw delivered consistent operating and financial results, as customers recognized the value, quality and convenience delivered through our diverse store formats, control brand products, and our PC Optimum loyalty program,” said Galen G. Weston, Chairman and President, Loblaw Companies Limited. “In the quarter we also continued to pursue our strategic growth agenda, with the completion of our acquisition of Lifemark Health Group, bolstering our healthcare services offering and furthering our purpose to help Canadians Live Life Well.”

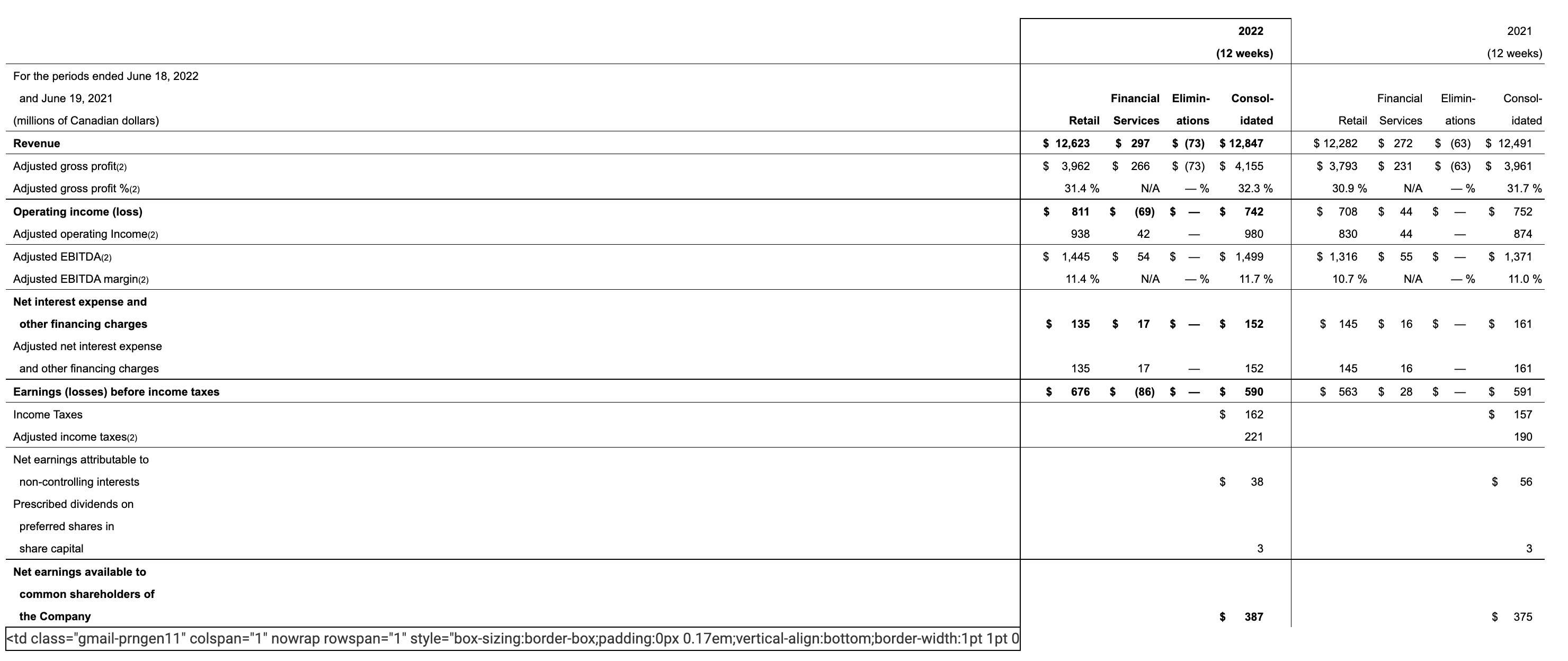

2022 SECOND QUARTER HIGHLIGHTS

- Revenue was $12,847 million, an increase of $356 million, or 2.9%.

- Retail segment sales were $12,623 million, an increase of $341 million, or 2.8%.

- Food Retail (Loblaw) same-stores sales increased by 0.9%.

- Drug Retail (Shoppers Drug Mart) same-store sales increased by 5.6%.

- E-commerce sales decreased by 17.5%, lapping elevated online sales due to lockdowns last year.

- Operating income was $742 million, a decrease of $10 million, or 1.3%. Operating income was negatively impacted by $111 million as a result of a charge related to a President’s Choice Bank (“PC Bank”) commodity tax matter.

- Adjusted EBITDA(2) was $1,499 million, an increase of $128 million, or 9.3%.

- Retail segment adjusted gross profit percentage(2) was 31.4%, an increase of 50 basis points.

- Net earnings available to common shareholders of the Company were $387 million, an increase of $12 million or 3.2%. Diluted net earnings per common share were $1.16, an increase of $0.07, or 6.4%. Diluted net earnings per common share was negatively impacted by $0.25 per common share as a result of a charge related to a PC Bank commodity tax matter.

- Adjusted net earnings available to common shareholders of the Company(2) were $566 million, an increase of $102 million, or 22.0%.

- Adjusted diluted net earnings per common share(2) were $1.69, an increase of $0.34 or 25.2%.

- Repurchased for cancellation, 5.4 million common shares at a cost of $607 million and invested $302 million in capital expenditures. Retail segment free cash flow(2) was $840 million.

- Acquired Lifemark Health Group (“Lifemark”) on May 10, 2022, adding to the Company’s growing role as a healthcare service provider, with a network of health and wellness solutions, accessible in-person and digitally.

- PC Express™ Rapid Delivery announced, to make grocery and convenience items available to customers in an expected express delivery time of 30-minutes-or-less through a collaboration with DoorDash.

See “News Release Endnotes” at the end of this News Release.

CONSOLIDATED AND SEGMENT RESULTS OF OPERATIONS

The following tables provide key performance metrics for the Company by segment and same-store sales.