GWL’s 2021 Second Quarter Report has been filed on SEDAR and is available at sedar.com and in the Investor Centre section of the Company’s website at weston.ca.

“We are pleased with the performance of our businesses as they lapped the most difficult quarter of the pandemic, with each delivering operational and financial improvements,” said Galen G. Weston, Chairman and Chief Executive Officer, George Weston Limited. “As economies continue to reopen in the second half of the year, our businesses are well-positioned to execute on their plans.”

Loblaw Companies Limited (“Loblaw”) delivered a strong financial performance in the second quarter of 2021. Revenue growth continued despite lapping the unprecedented demand in the previous year from stockpiling by consumers at the start of COVID-19. Consolidated gross margin improved significantly, reflecting a heightened focus on the core retail business, including promotional effectiveness and cost controls. Loblaw maintained its focus on delivering value and quality to its customers in a safe shopping environment and is well-positioned to meet the evolving needs of customers as pandemic restrictions lift and economies re-open.

Choice Properties Real Estate Investment Trust (“Choice Properties”) generated solid results in the second quarter of 2021, collecting 98% of contractual rents despite continued regional lockdowns across Canada. Choice Properties continued to advance its development initiatives, drive meaningful net asset value appreciation and improve its balance sheet. Net asset value per unit increased by 3.6% driven primarily by gains from the industrial portfolio, 149,000 square feet of the new gross leasable area was transferred to income-producing assets, and Choice Properties lowered its leverage ratio through the early repayment of $200 million of debentures.

Weston Foods delivered much improved financial results in the second quarter of 2021 compared to the same quarter in 2020. Sales grew in food service and retail as government-mandated lockdowns were lifted in many regions of Canada and the United States. In addition to the increase in sales, lower pandemic-related costs and continued productivity improvements contributed to the year-over-year earnings growth. In the second quarter, Weston Foods was faced with higher-than-expected input, labour and distribution costs. The higher costs, together with labour availability challenges, negatively impacted sales and earnings. These factors were primarily the result of a surge in global demand for consumer goods as economies began to reopen following the lifting of many lockdown restrictions. Weston Foods has taken steps, including pricing, to help mitigate the impact of cost inflation, and expects the labour availability challenges will ease over time. The business is well-positioned to meet the increasing demand from its customers and continue to offer superior products and services.

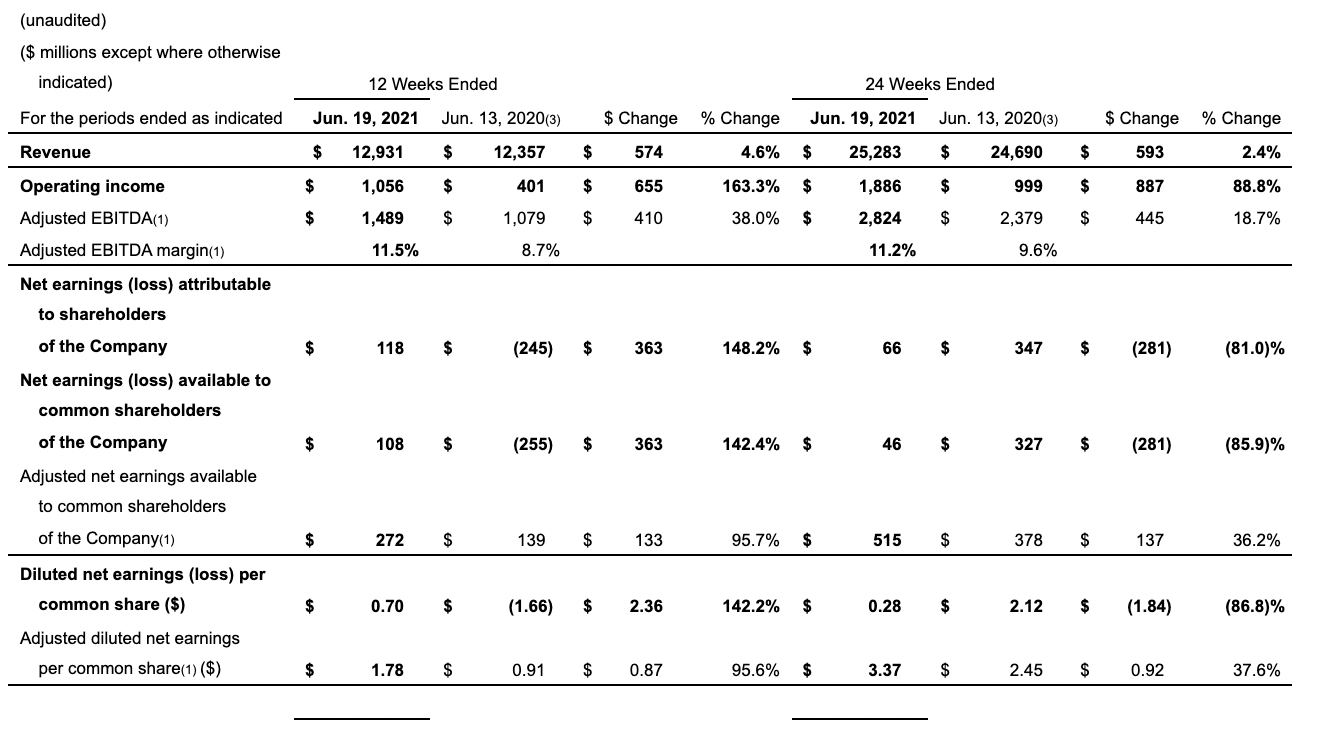

2021 SECOND QUARTER HIGHLIGHTS

George Weston Limited’s net earnings available to common shareholders of the Company were $108 million ($0.70 per common share) an increase of $363 million ($2.36 per common share) when compared to the same period in 2020. The increase was due to the favourable year-over-year net impact of adjusting items totaling $230 million ($1.49 per common share), which was primarily due to the favourable year-over-year impact of the fair value adjustment on investment properties of $203 million ($1.33 per common share) at Choice Properties, net of consolidation adjustments in Other and Intersegment, and an improvement of $133 million ($0.87 per common share) in the Company’s consolidated underlying operating performance.

Adjusted net earnings available to common shareholders of the Company(1) in the second quarter of 2021 were $272 million ($1.78 per common share). In comparison to the same period in 2020, this represented an increase of $133 million ($0.87 per common share), or 95.7%, primarily due to the improvement in the underlying operating performance of Loblaw, Choice Properties and Weston Foods. The increase in adjusted diluted net earnings per common share(1) of $0.87, or 95.6%, was due to the performance in adjusted net earnings available to common shareholders(1) and the favourable impact of share repurchases.

Quarterly common share dividend to be increased by $0.05, or 9.1%, from $0.550 per common share to $0.600 per common share.

CONSOLIDATED RESULTS OF OPERATIONS

The Company’s results reflect the impact of COVID-19 and the year-over-year impact of the fair value adjustment of the Trust Unit liability as a result of the significant changes in Choice Properties’ unit price, recorded in net interest expense and other financing charges. The Company’s results are impacted by market price fluctuations of Choice Properties’ Trust Units on the basis that the Trust Units held by unitholders, other than the Company, are redeemable for cash at the option of the holder and are presented as a liability on the Company’s consolidated balance sheet. The Company’s financial results are negatively impacted when the Trust Unit price rises and positively impacted when the Trust Unit price declines.

In the second quarter of 2021, the Company recorded net earnings available to common shareholders of the Company of $108 million ($0.70 per common share), an increase of $363 million ($2.36 per common share) compared to the same period in 2020. The increase was due to the favourable year-over-year net impact of adjusting items totalling $230 million ($1.49 per common share), and an improvement of $133 million ($0.87 per common share) in the consolidated underlying operating performance of the Company described below.

- The favourable year-over-year net impact of adjusting items totalling $230 million ($1.49 per common share) was due to:

- the favourable year-over-year impact of the fair value adjustment on investment properties of $203 million ($1.33 per common share) primarily driven by Choice Properties, net of consolidation adjustments in Other and Intersegment; and

- the favourable year-over-year impact of the fair value adjustment of the Trust Unit liability of $69 million ($0.44 per common share) as a result of the increase in Choice Properties’ unit price in the second quarter of 2021;

- the unfavourable year-over-year impact of the fair value adjustment of the forward sale agreement of Loblaw common shares of $52 million ($0.34 per common share).

- The improvement in the Company’s consolidated underlying operating performance of $133 million ($0.87 per common share) was due to:

- the favourable underlying operating performance of Loblaw, Choice Properties and Weston Foods;

- an increase in depreciation and amortization.

- Diluted net earnings per common share also included the favourable impact of shares purchased for cancellation in the fourth quarter of 2020 and in the first and second quarters of 2021.

Adjusted net earnings available to common shareholders of the Company(1) were $272 million, an increase of $133 million, or 95.7%, compared to the same period in 2020 due to the improvement in the Company’s consolidated underlying operating performance described above. Adjusted diluted net earnings per common share(1) was $1.78 per common share in the second quarter of 2021, an increase of $0.87 per common share, or 95.6%, compared to the same period in 2020. The increase was due to the performance in adjusted net earnings available to common shareholders(1) and the favourable impact of share repurchases.

CONSOLIDATED OTHER BUSINESS MATTERS

COVID-19 R